Customs 101 A Novices Guide To Classification

Customs 101 A Novice S Guide To Classification Youtube A 1 hour introduction to tariff codes and how to identify which codes apply to your goods or component parts. the webinar was delivered by steve cock from th. Section 18 (chapters 90 92): optical, cinematic, measuring, musical and medical apparatus and instruments. section 19 (chapter 93): arms and ammunition. section 20 (chapters 94 96): miscellaneous: toys, furniture, games, signs. section 21 (chapters 97 99): works of art and tariff provisions reserved for special use.

Webinars Global Customs Academy Informed compliance publication. what every member of the trade community should know about: tariff classification. this document may qualify as a "guidance document" as set forth in executive order 13891 and interpretations thereof; such guidance documents are not binding and lack the force and effect of law, except as authorized by law or as. This 1.5 hour webinar for novice and experienced classifiers alike will cover the basics of the classification process and help you effectively evaluate tariff classification and related considerations, including the role classification may play in section 232 301 origin determinations, tariff exclusions, and recent court decisions. Customs 101: customs freight simplified procedures. customs 101: a novice's guide to classification. customs 101: the need for declarations, how free trade agreements and customs union differ & brexit. customs 101: how will the northern ireland protocol work for uk businesses. international freight post transition. incoterms 2020. Merchandise processing fee (mpf): collected on most shipments at about 0.34% of shipment value in the us. a minimum of $27.23 and a maximum of $528.33 is charged, not including customs duty, freight, and insurance charges. harbor maintenance fee (hmf): collected on all ocean freight at 0.125% of the shipment value.

Introduction To Customs Classification Part 1 Customs And Customs Customs 101: customs freight simplified procedures. customs 101: a novice's guide to classification. customs 101: the need for declarations, how free trade agreements and customs union differ & brexit. customs 101: how will the northern ireland protocol work for uk businesses. international freight post transition. incoterms 2020. Merchandise processing fee (mpf): collected on most shipments at about 0.34% of shipment value in the us. a minimum of $27.23 and a maximum of $528.33 is charged, not including customs duty, freight, and insurance charges. harbor maintenance fee (hmf): collected on all ocean freight at 0.125% of the shipment value. The us customs and border protection (cbp) is the agency responsible for enforcing us customs regulations and ensuring the security of the nation’s borders. understanding the role and functions of the cbp is essential for importers, as it directly impacts the importation process. in this section, we will provide an overview of the cbp and its. To be successful as a new exporter, you first need to understand the basic mechanics of exporting. this training series introduces twelve key topics — each broken into 3 5 short videos, easily viewed in any order. these videos are based on an ita webinar series in partnership with ncbfaa. ecommerce best practices.

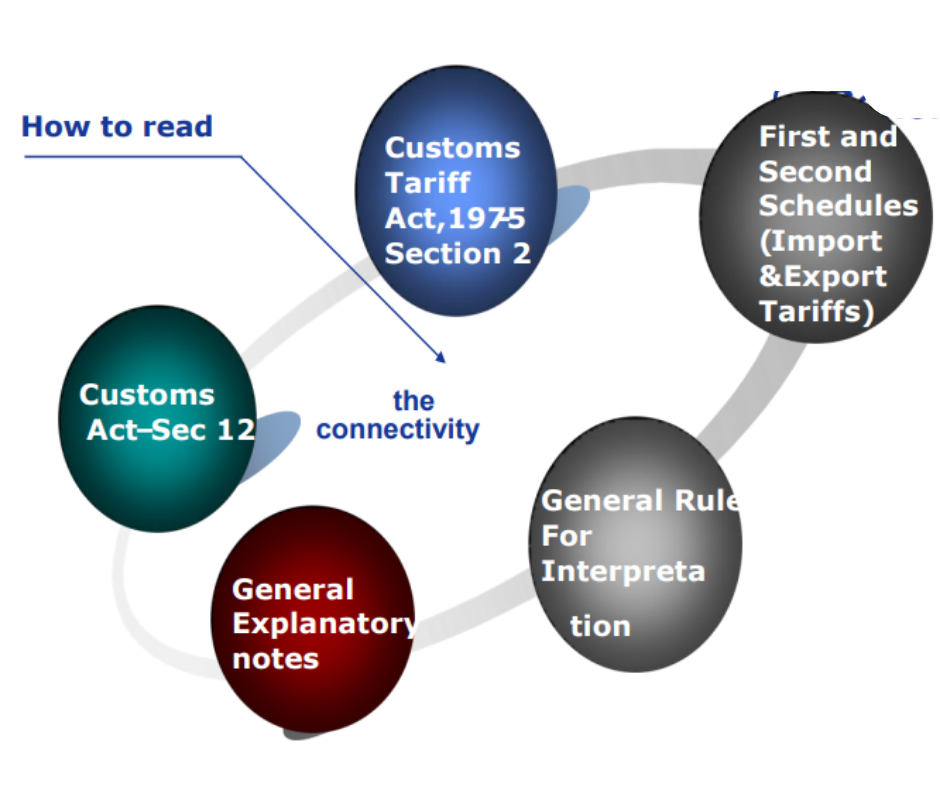

Classification Of Goods Under Customs And Gst Law The us customs and border protection (cbp) is the agency responsible for enforcing us customs regulations and ensuring the security of the nation’s borders. understanding the role and functions of the cbp is essential for importers, as it directly impacts the importation process. in this section, we will provide an overview of the cbp and its. To be successful as a new exporter, you first need to understand the basic mechanics of exporting. this training series introduces twelve key topics — each broken into 3 5 short videos, easily viewed in any order. these videos are based on an ita webinar series in partnership with ncbfaa. ecommerce best practices.

Comments are closed.