Completing The Fafsa What Assets Can Cost Students Financial Aid

Completing The Fafsa What Assets Can Cost Students Financial Aid Youtube For example, real estate investments, ugma utma accounts, mutual fund assets, and 529 plans can reduce the amount of aid you’re eligible for, while protected parent assets like 401 (k) and roth ira accounts will not have any impact. you may also be wondering if your parents’ savings account will affect your financial aid, yes it may, as. Completing the fafsa can be overwhelming especially when there’s so much financial information your family has to share. this video explains what is fafsa, a.

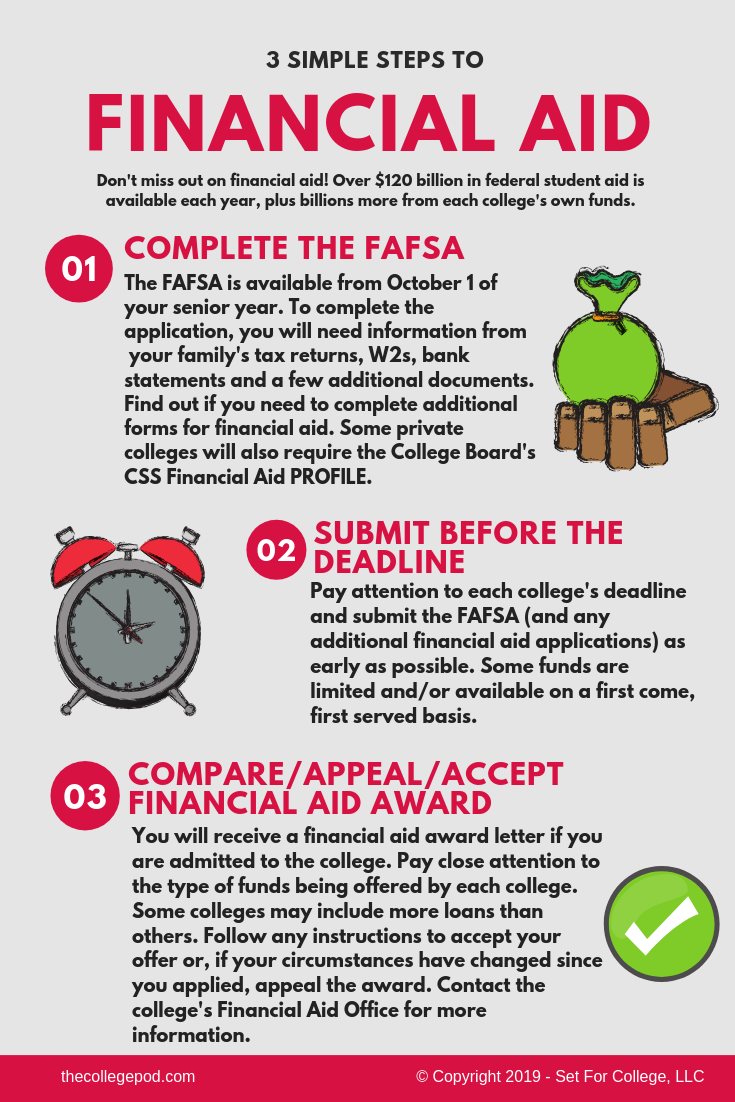

3 Simple Steps To Financial Aid The College Pod The 2024–25 free application for federal student aid (fafsa ®) form will be available by dec. 31, 2023—with some changes for you and your family. get ready now so you can complete the fafsa form as soon as it’s available at fafsa.gov. here’s what you’ll need to access and complete your form. 1 your studentaid.gov account. Assets you should include on the fafsa. according to studentaid.gov, these are assets you need to report on the fafsa: money in checking accounts, cash and savings accounts. real estate. while fafsa does not consider your parent’s primary residence as an asset, you need to declare the net worth of any additional property. The fafsa is the financial aid form for accessing grants, federal student loans and work study funds. by emma kerr and sarah wood. nov. 30, 2023, at 4:04 p.m. filling out the free application for. That’s why we’ve broken down the 2024 25 fafsa® to help you understand why each question is asked, and how to answer each one accurately. need expert help with a question? call fafsa® support at 800 433 3243 (800 730 8913 tdd). you may also want to talk to a financial or legal professional.

Complete Step By Step Guide On Fafsa How To Get The Most Financial The fafsa is the financial aid form for accessing grants, federal student loans and work study funds. by emma kerr and sarah wood. nov. 30, 2023, at 4:04 p.m. filling out the free application for. That’s why we’ve broken down the 2024 25 fafsa® to help you understand why each question is asked, and how to answer each one accurately. need expert help with a question? call fafsa® support at 800 433 3243 (800 730 8913 tdd). you may also want to talk to a financial or legal professional. An asset is something that holds value. this includes cash, stocks, and real estate. you and your parents will report certain assets on the fafsa, backing up any claims with paperwork. these asset records are then used as part of the calculation for your student aid index (sai) (previously efc), which determines how much need based federal aid. Students can enter the school's name, cost of attendance, financial aid offer, and more in order to compare the net costs of attending several schools. meanwhile, hundreds of schools use the college financing plan , a document that sets out the school's aid offer in a simple way so the student can easily understand it and compare it to offers.

Complete Step By Step Guide On Fafsa How To Get The Most Financial An asset is something that holds value. this includes cash, stocks, and real estate. you and your parents will report certain assets on the fafsa, backing up any claims with paperwork. these asset records are then used as part of the calculation for your student aid index (sai) (previously efc), which determines how much need based federal aid. Students can enter the school's name, cost of attendance, financial aid offer, and more in order to compare the net costs of attending several schools. meanwhile, hundreds of schools use the college financing plan , a document that sets out the school's aid offer in a simple way so the student can easily understand it and compare it to offers.

Fafsa Grts Financial Aid

Comments are closed.