Buy Now Pay Later Just Became Even More Dangerous The Dark Side Of Bnpl

Bnpl 101 Understanding The Basics Of Buy Now Pay Later Payment Buy now, pay later companies have been cementing themselves as a top way to pay for your purchases allowing customers to pay less right away, but still get. The rise in buy now, pay later offers. according to a recent study on buy now, pay later options from cardify.ai, you're definitely not imagining it if you have seen a lot more flexible payment.

Infographic Credit Card Killer The Rise Of Bnpl Buy Now Pay Later More than 40 percent of american shoppers have used a buy now pay later plan, according to a recent credit karma qualtrics survey, with the highest usage among gen z and younger millennials. of. The dark side of buy now, pay later: risks facing the banking industry subscribe now get the financial brand's free email newsletter fintechs created – and have so far dominated – the super hot bnpl market, but banks, credit unions and just about every other player in the consumer credit and payments markets is rushing to assess bnpl's impact and weigh their options. From 2019 to 2021, the total value of buy now, pay later (or bnpl) loans originated in the united states grew more than 1,000 percent, from $2 billion to $24.2 billion. that’s still a small. “buy now, pay later” apps give millions of users the chance to instantly purchase what they want, then pay off the item in installments. but as the services extend from small ticket items to.

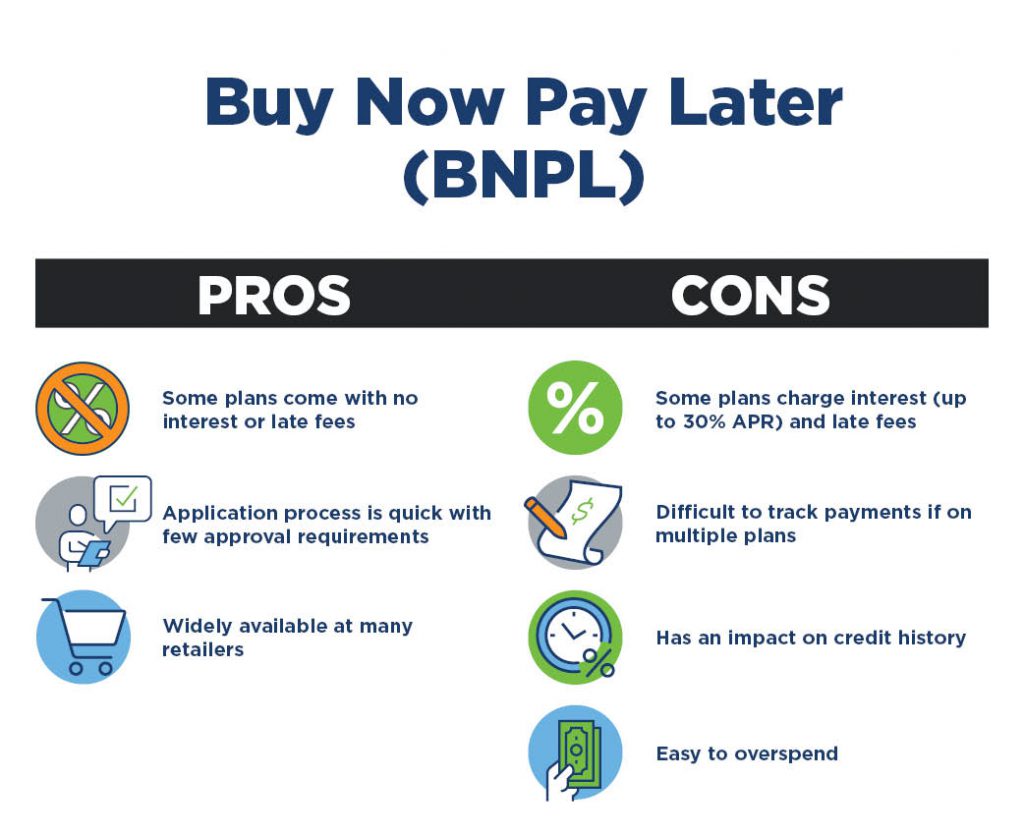

Buy Now Pay Later Bnpl Meaning Examples Pros Cons From 2019 to 2021, the total value of buy now, pay later (or bnpl) loans originated in the united states grew more than 1,000 percent, from $2 billion to $24.2 billion. that’s still a small. “buy now, pay later” apps give millions of users the chance to instantly purchase what they want, then pay off the item in installments. but as the services extend from small ticket items to. October 7, 2022. this headline a year ago left me scratching my head: “ how buy now, pay later became a $100 billion industry.”. as it happens, buy now, pay later (bnpl) breached the $100 billion in mark in 2020 and soared to $157 billion in 2021, according to fico partner worldpay. even more dramatic, paypal, a relatively late arrival to. Print. buy now pay later (bnpl) is a payment option that has increased in popularity over the last few years. in the 2021 woolard review, the fca outlined a number of potential harms that the unregulated bnpl market presents to consumers, stating that the unregulated bnpl market “needs to be brought within regulation to both protect consumers.

What You Should Know About Buy Now Pay Later Bnpl Bankers Trust October 7, 2022. this headline a year ago left me scratching my head: “ how buy now, pay later became a $100 billion industry.”. as it happens, buy now, pay later (bnpl) breached the $100 billion in mark in 2020 and soared to $157 billion in 2021, according to fico partner worldpay. even more dramatic, paypal, a relatively late arrival to. Print. buy now pay later (bnpl) is a payment option that has increased in popularity over the last few years. in the 2021 woolard review, the fca outlined a number of potential harms that the unregulated bnpl market presents to consumers, stating that the unregulated bnpl market “needs to be brought within regulation to both protect consumers.

:max_bytes(150000):strip_icc()/buy-now-pay-later-5182291-final-4dcaa9bea32a4aa398eb99e5ca5406bb.png)

Buy Now Pay Later Bnpl What It Is How It Works Pros And Cons

Comments are closed.