Business Meals 50 Deduction 100 Percent Deduction Tax Planning For

Business Meals 50 Deduction 100 Percent Deduction Taxођ Ir 2022 100, may 3, 2022 — the irs today urged business taxpayers to begin planning now to take advantage of the enhanced 100% deduction for business meals and other tax benefits available to them when they file their 2022 federal income tax return. If the business sells food, employers can still deduct 100% of meals given to employees between, before, or after shifts. potentially limited to 50 percent, per october 2020 final irs regulations (formerly 100% deductible): office snacks, including coffee, soft drinks, bottled water, donuts, and similar snacks or beverages provided to employees.

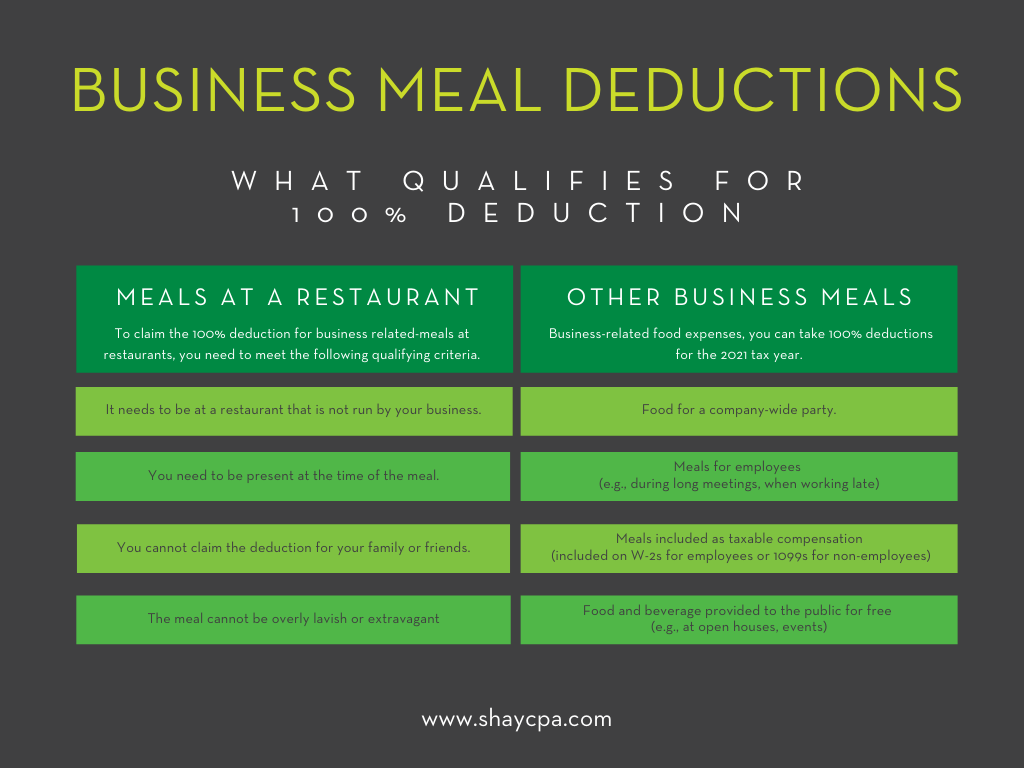

New Tax Deduction Business Meals Are 100 Deductible In 2021 Meals can only be deducted as a business expense if they are directly related or associated with the active conduct of a trade or business. there must be valid business purpose to the meal for it to be a deductible expense. once this test is established, the expense falls into two categories: 50% deductible or 100% deductible. The business meal deduction was cut to 80% of the cost in 1986, 6 then to 50% of the cost, effective jan. 1, 1994. 7 (for 2021 and 2022, the deduction is 100% for meals purchased from a restaurant. 8) over 56 years after president john f. kennedy denounced the tax deductibility of business "expense account living," 9 section 13304 of the law. This includes the enhanced business meal deduction. for 2021 and 2022 only, businesses can generally deduct the full cost of business related food and beverages purchased from a restaurant. otherwise, the limit is usually 50% of the cost of the meal. to qualify for the enhanced deduction:. Temporary deduction of 100% business meals. the 100% deduction on certain business meals expenses as amended under the taxpayer certainty and disaster tax relief act of 2020, and enacted by the consolidated appropriations act, 2021, has expired. generally, the cost of business meals remains deductible, subject to the 50% limitation.

100 Deduction For Business Meals In 2021 And 2022 Alloy Silverstein This includes the enhanced business meal deduction. for 2021 and 2022 only, businesses can generally deduct the full cost of business related food and beverages purchased from a restaurant. otherwise, the limit is usually 50% of the cost of the meal. to qualify for the enhanced deduction:. Temporary deduction of 100% business meals. the 100% deduction on certain business meals expenses as amended under the taxpayer certainty and disaster tax relief act of 2020, and enacted by the consolidated appropriations act, 2021, has expired. generally, the cost of business meals remains deductible, subject to the 50% limitation. The business meal deduction for the cost of food and beverages provided by a restaurant rises from 50 percent to 100 percent in 2021 and 2022, if certain conditions are met. irs guidance explains. Prior to the tax cuts and jobs act (tcja) of 2018, businesses could deduct up to 50% of entertainment and meal expenses, provided they were associated with conducting or discussing business. the tcja eliminated the deduction for most forms of entertainment but allowed taxpayers to continue deducting 50% of the cost of business meals.

Are Business Meals Deductible In 2024 A Comprehensive Guide For Tax The business meal deduction for the cost of food and beverages provided by a restaurant rises from 50 percent to 100 percent in 2021 and 2022, if certain conditions are met. irs guidance explains. Prior to the tax cuts and jobs act (tcja) of 2018, businesses could deduct up to 50% of entertainment and meal expenses, provided they were associated with conducting or discussing business. the tcja eliminated the deduction for most forms of entertainment but allowed taxpayers to continue deducting 50% of the cost of business meals.

Comments are closed.