Build Wealth With The 3 Bucket Strategy In Your 50s 2023 Edit

The Benefits Of The Three Bucket Retirement Income Strategy Heron Strategic allocation of your buckets pre retirement can make accessing your money less costly. for those in their 50s to 75, there are opportunities to convert tax deferred assets into tax free assets. this can be done by transitioning to a lower tax bracket or by utilizing after tax assets. prioritize using after tax buckets first, followed by. In your 50s and later, you are fine tuning your plan for retirement. take advantage of catch up contributions in employer plans and roth iras.jump start your.

Build Wealth With The 3 Bucket Strategy In Your 50s 202 Manny, who started investing 25% of his gross income at age 25, never intended to retire in his 40s or 50s. he planned to work until age 65, not aligning with the fire movement's early retirement goal. manny's decisions on how he accumulates wealth are specific to his long term plan. We believe there are three distinct taxable buckets you have the option of investing in for retirement. we’ll talk about how to balance those buckets by age. Again, it's okay if this bucket isn't growing. if you're someone who's part of the fire movement and you want to exit the workforce in your 40s or early 50s, you may need to adjust. however, for the majority of folks who are building, there's a good chance that even in your 30s, the after tax bucket is not going to get a lot of love. How to build wealth with the 3 bucket strategy in your 50s!take your finances to the next level ️ subscribe now: c moneyguyshow?sub.

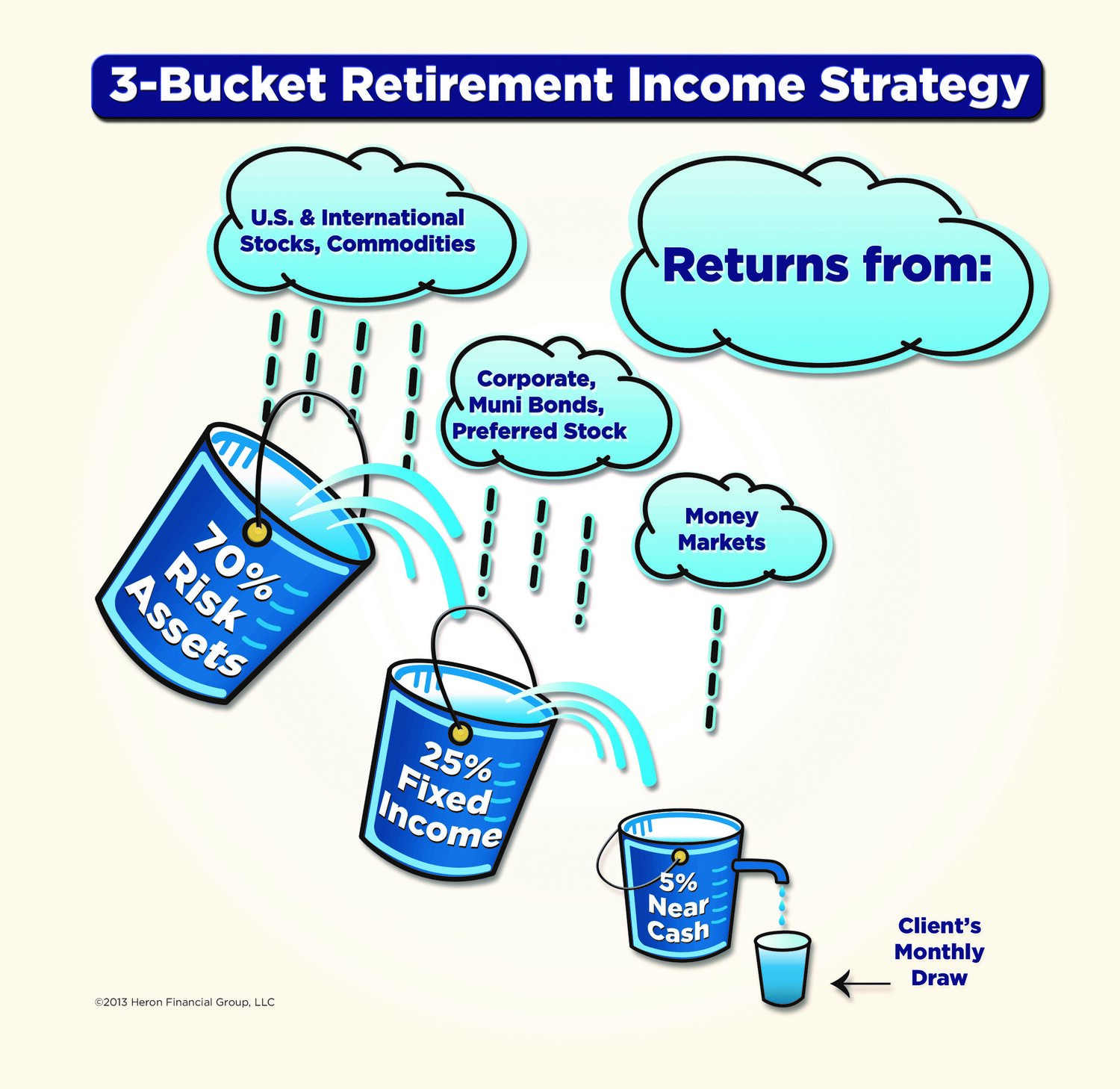

Build Wealth With The 3 Bucket Strategy By Age 2023 Edition Again, it's okay if this bucket isn't growing. if you're someone who's part of the fire movement and you want to exit the workforce in your 40s or early 50s, you may need to adjust. however, for the majority of folks who are building, there's a good chance that even in your 30s, the after tax bucket is not going to get a lot of love. How to build wealth with the 3 bucket strategy in your 50s!take your finances to the next level ️ subscribe now: c moneyguyshow?sub. The 3 bucket strategy is a simple, yet powerful approach to managing your money. it involves dividing your assets into three distinct buckets: tax deferred bucket: these are your traditional retirement accounts like 401 (k)s and iras, where you save now and pay taxes later. tax free bucket: think roth iras and roth 401 (k)s, where you pay taxes. Small business owners' total contribution limit for a 401 (k) is $66,000 in 2023. if you are 50 or older, you can also make a $7,500 catch up contribution. for high income earning business owners.

Comments are closed.