Breaking Update On How To Get Your Student Loans Forgiven Borrower

Breaking Update On How To Get Your Student Loans Forgiven Borrower Borrowers must have taken out no more than $12,000 in student loans to qualify. for every $1,000 borrowed above the $12,000 limit, borrowers can receive forgiveness after an extra year of. If a borrower hasn’t successfully enrolled in an income driven repayment (idr) plan but would be eligible for immediate forgiveness, they would be eligible for relief. borrowers who would be eligible for closed school discharge or other types of forgiveness opportunities but haven’t successfully applied would also be eligible for this relief.

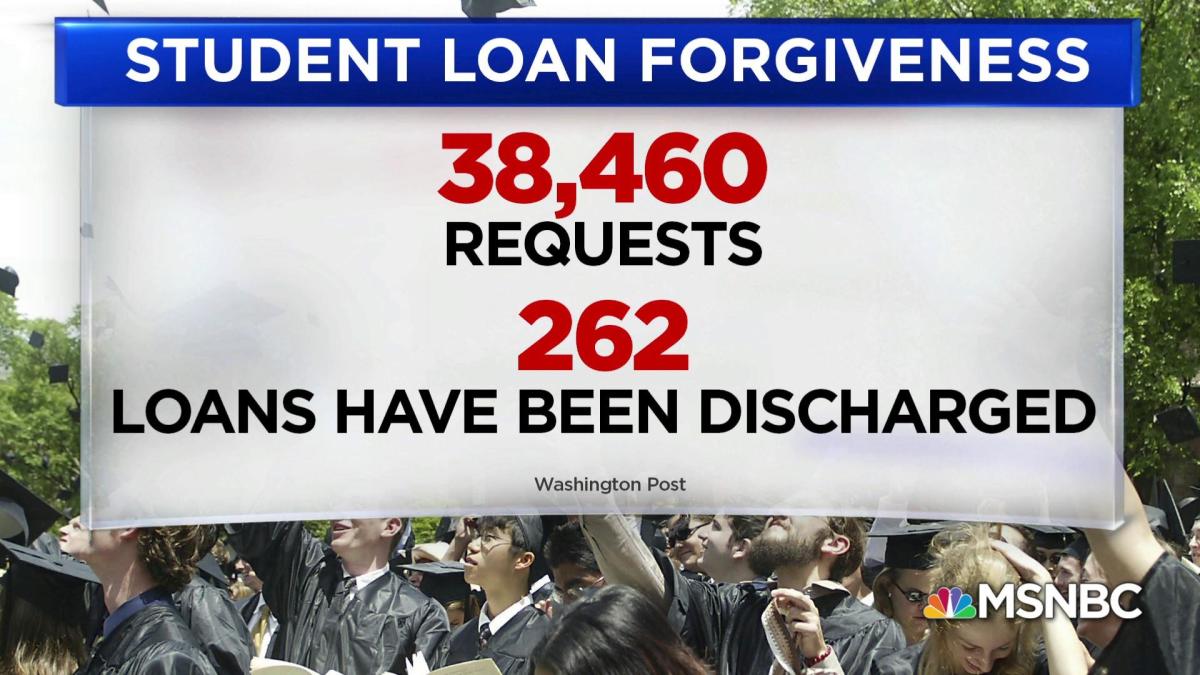

Get Your Student Loans Forgiven Borrower Defense To Repay Applic The supreme court blocked the one time debt relief plan (you may also know this as the forgiveness of up to $20,000 for pell grant borrowers). but you may be able to get help repaying your loans, including full loan forgiveness, through other federal student loan programs. For a borrower to be eligible for this forgiveness they must be enrolled in the save plan, have been making at least 10 years of payments, and have originally taken out $12,000 or less for college. for every $1,000 borrowed above $12,000, a borrower can receive forgiveness after an additional year of payments. Under the higher education act and the department’s regulations, a borrower is eligible for forgiveness after making 240 or 300 monthly payments—the equivalent of 20 or 25 years on an idr plan or the standard repayment plan, with the number of required payments varying based upon when a borrower first took out the loans, the type of loans. President biden laid out a sweeping plan in august to cancel up to $20,000 in federal student loan debt per borrower. to get that maximum, individuals must earn less than $125,000 a year, or less.

How To Have Your Federal Student Loans Forgiven The University Network Under the higher education act and the department’s regulations, a borrower is eligible for forgiveness after making 240 or 300 monthly payments—the equivalent of 20 or 25 years on an idr plan or the standard repayment plan, with the number of required payments varying based upon when a borrower first took out the loans, the type of loans. President biden laid out a sweeping plan in august to cancel up to $20,000 in federal student loan debt per borrower. to get that maximum, individuals must earn less than $125,000 a year, or less. Individuals making less than $120,000 a year, or couples making less than $240,000, would qualify to have full forgiveness of their interest. people who have owed on loans for at least 20 years. An important student loan forgiveness deadline is hours away — and it takes under 15 minutes to apply. some student loan borrowers have until the end of tuesday to take advantage of an.

Comments are closed.