Bonus Depreciation 2024 Irs Windy Kakalina

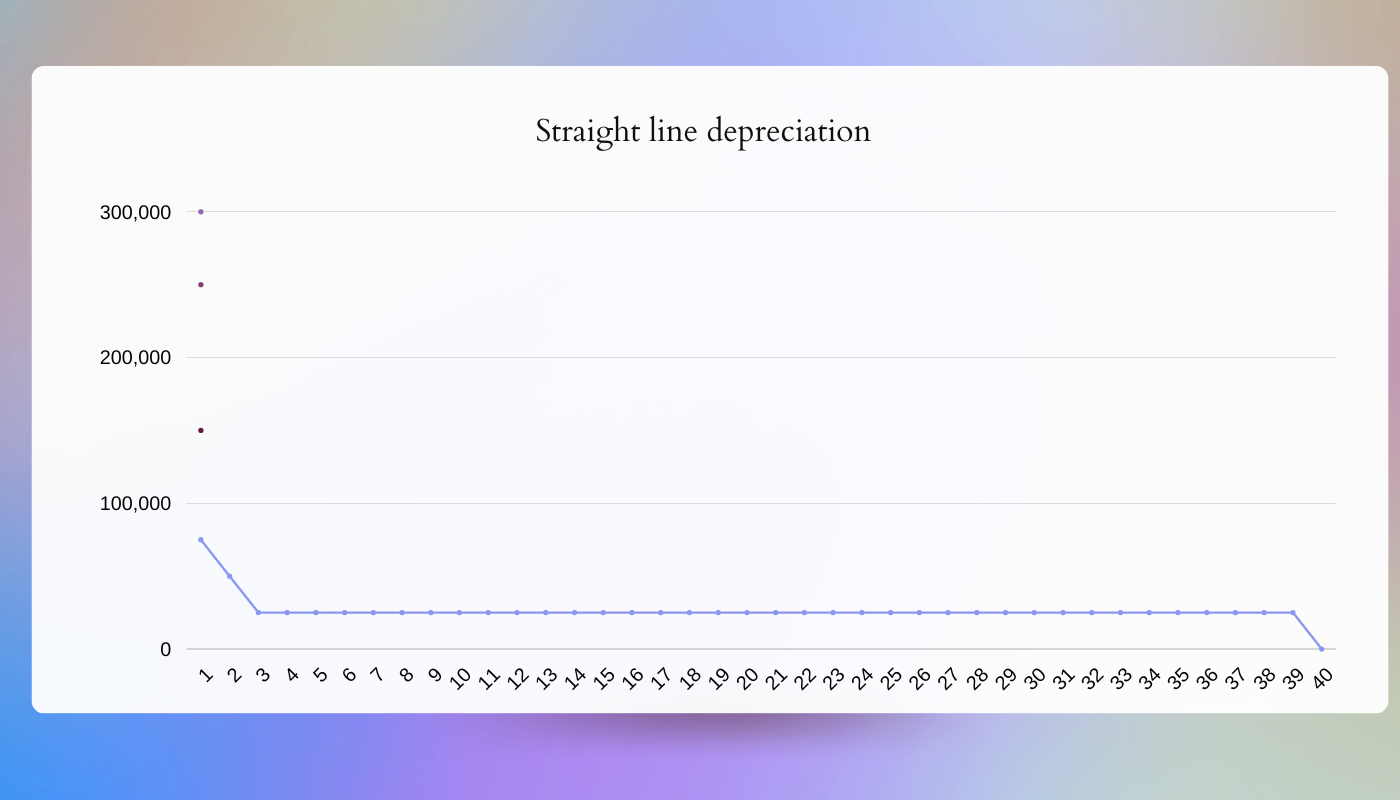

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Bonus Depreciation 2024 And 2024 Windy Kakalina A6: first, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). prior to enactment of the tcja, the additional first year depreciation deduction applied only to property where the original use began with the taxpayer. the new law expands the definition of qualified property to. Extension of 100% bonus depreciation. the bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026. without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. deductions for r&d.

Bonus Depreciation 2024 Irs Windy Kakalina The full house passed late wednesday by a 357 to 70 vote h.r. 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research and. If business use is 50% or less, you can’t claim any bonus depreciation or sec. 179 expensing. irs guidance provides the 2024 depreciation limits for “luxury” business vehicles. for vehicles placed in service in 2024, depreciation limits (including first year bonus depreciation) are $20,400 for year one, $19,800 for year two, $11,900 for. For 2024, aim to place assets into service before the rate drops further in 2025. combine with section 179: utilize both bonus depreciation and section 179 expensing to maximize tax savings. while section 179 provides an upfront deduction up to a certain limit, bonus depreciation allows for the immediate write off of 60% of the remaining cost. To calculate bonus depreciation for a specific asset: subtract any section 179 expense deduction for the year from the original cost of the asset. reduce the basis by the applicable percentage of any credits claimed (such as the energy credit). multiply the bonus rate (60% for 2024) by the remaining cost of the asset.

Bonus Depreciation 2024 Real Estate Windy Kakalina For 2024, aim to place assets into service before the rate drops further in 2025. combine with section 179: utilize both bonus depreciation and section 179 expensing to maximize tax savings. while section 179 provides an upfront deduction up to a certain limit, bonus depreciation allows for the immediate write off of 60% of the remaining cost. To calculate bonus depreciation for a specific asset: subtract any section 179 expense deduction for the year from the original cost of the asset. reduce the basis by the applicable percentage of any credits claimed (such as the energy credit). multiply the bonus rate (60% for 2024) by the remaining cost of the asset. The increase from 2021 to 2022 and 2022 to 2023 was $1,000 each year. the succeeding year limitations are $19,800 for the second tax year (an increase of $300 over 2023); $11,900 for the third year ($200 higher); and $7,160 for each year after that (an increase of $200). if bonus depreciation does not apply, the 2024 first year limitation is. Then, deduct the tax of the property from the cost of the asset. for example: amount of bonus depreciation: cost of asset $1,000,000 x 21% tax rate = $210,000 bonus depreciation can be claimed. cost of asset $1,000,000 $210,000 bonus depreciation = $790,000 depreciated value of the asset.

Comments are closed.