Being Tracked To Save On Car Insurance Consumer Reports

Being Tracked To Save On Car Insurance Consumer Reports Research by the zebra, a car insurance search engine, found that drivers in connecticut using telematics get the largest average discount on an annual policy: $102. the median for all states and. 3. take a defensive driving course. how much you can save: $233 a year. some insurance companies will allow you to take a safe driving course to get a discount, although you’ll have to take it.

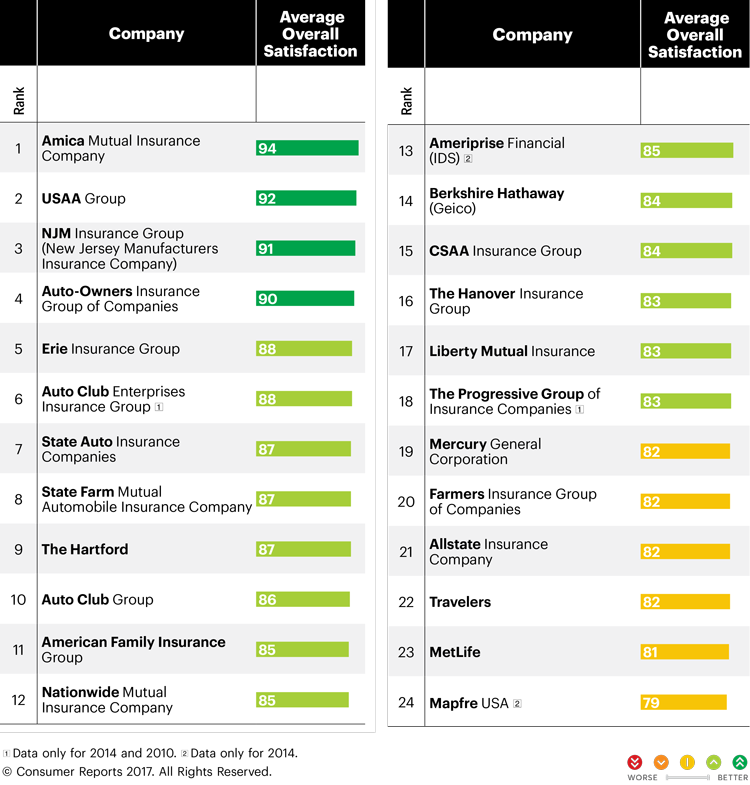

Two Decades Of Consumer Reports Car Insurance Survey Results A 2021 j.d. power survey found that 16 percent of u.s. car insurance customers have signed up for a telematics program, and 34 percent say they’re willing to try one. the cost savings can be. Imagine paying less for car insurance just for being a good driver. it’s called usage based insurance: drive safely and keep to certain mileage limits and you could save a bundle on premiums. Some insurance companies offer programs that track your driving habits using telematics technology. if you practice safe driving, you could earn a discount on your rate. but there are some risks. The good news: there are ways to save. consumer reports reveals five ways to get your premiums as low as possible. 5. increase your deductible. now might be the time if you haven’t raised your.

Comments are closed.