Basics Of Stock Market Fundamental Analysis Technical Analysis

What Is Fundamental And Technical Analysis вђ Stock Phoenix The bottom line. fundamental analysis is used to value a company and determine whether a stock is over or undervalued by the market. it considers the economic, market, sector specific, and. Forex analysis and trading: effective top down strategies combining fundamental, position, and technical analyses. john wiley & sons, 2010. as, suresh. "a study on fundamental and technical analysis.".

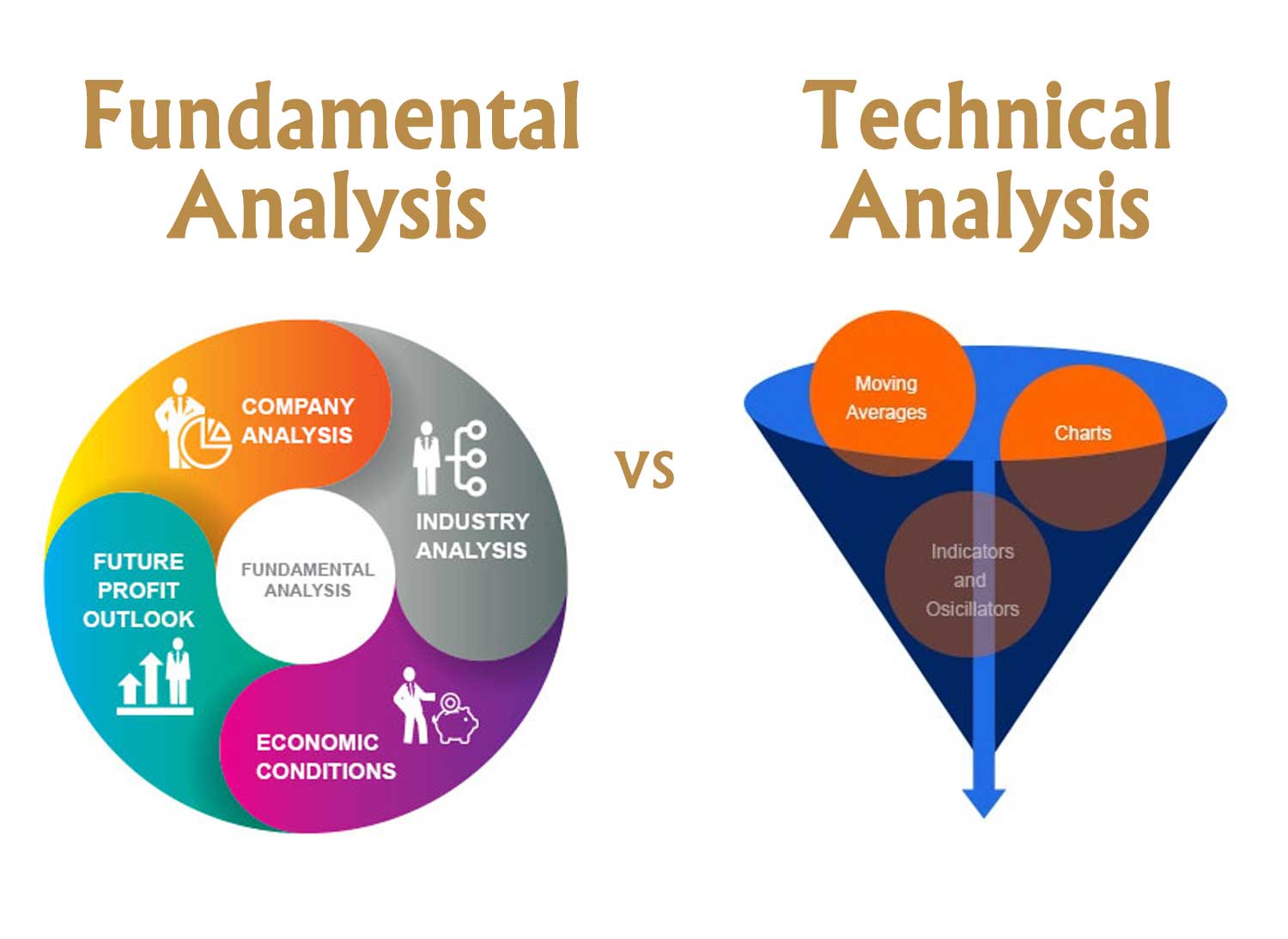

Fundamental Analysis Vs Technical Analysis Stockmaniacs Stock market basics investing: an introduction technical analysis differs from fundamental analysis in that the stock's price and volume are the only inputs. the core assumption is that all. Learning the basics of stock analysis is essential if you are looking to navigate the market successfully. fundamental analysis enables you to assess a company's intrinsic value and long term growth potential, while technical analysis utilises historical price data to predict short term price movements. Technical analysis can be applied to stocks, indexes, commodities, futures, or any tradable instrument where the price is influenced by supply and demand. price data (or, as john murphy calls it, “market action”) refers to any combination of the open, high, low, close, volume, or open interest for a given security over a specific timeframe. Fundamental and technical analysis are two common ways to sort and pick stocks. how and when to use them can be a matter of personal style, but each has its strengths. fundamental analysis attempts to identify stocks offering strong growth potential at a good price by examining the underlying company's business, as well as conditions within its.

Comments are closed.