Axa Reveals New Infographics On Insurtech In China The Digital Insurer

China Spotlight Axa Reveals New Infographics On Insurtech In We are very pleased to have been given the opportunity to launch axa’s new infographics on insurtech in china. as you know the digital insurer was started in asia in 2012 and we are firm believers that the region is the “crucible” of innovation in digital insurance where there is the opportunity for ideas and innovation to flow into and out of the region. Axa infographic on insurtech in china download as a pdf or view online for free. submit search. upload. 15 likes • 15,067 views. the digital insurer follow.

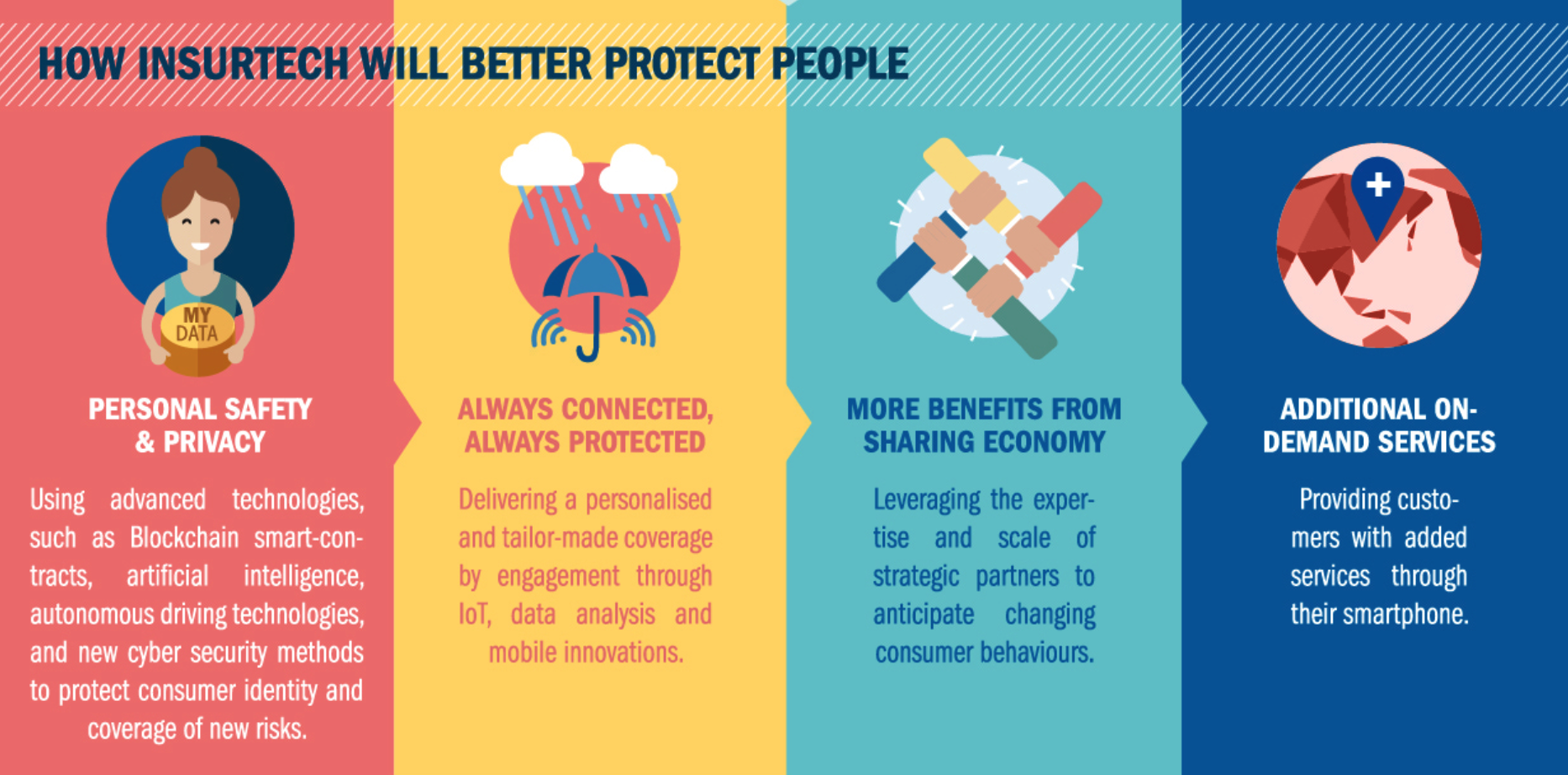

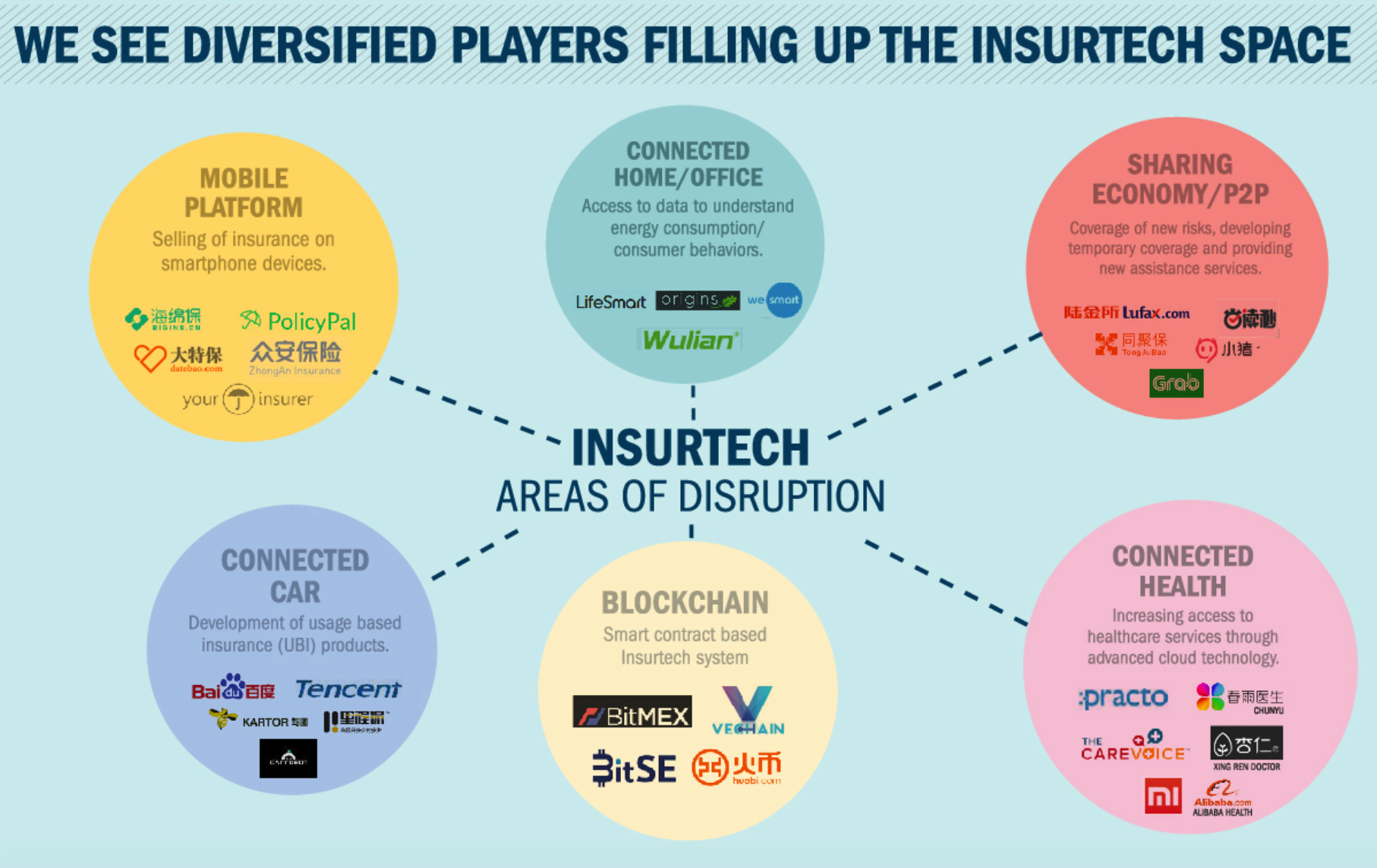

Axa Reveals New Infographics On Insurtech In China The Digital Insurer Ceo interview: axa in china, adapting, evolving. view newsletter. yamin zhu (pictured), ceo of axa tianping, axa’s wholly owned p&c company in china, speaks to the digital insurer about how axa is adapting to the rapidly changing chinese market. q.1 can you tell us more about axa’s digital projects in china, and partnerships axa has engaged. For example, tapping the digital capabilities and extensive user base of large internet companies can deliver exponential growth for insurers intent on designing innovative risk protection solutions tailored to specific consumer needs. in the coming years, insurtech will further progress the transformation of china's insurance industry, by:. There are at least 335 private insurtechs operating in apac, with china and india collectively home to nearly half of private insurtech firms in apac and attracting 78% of insurtech investments in the region, according to data by s&p global market intelligence. other jurisdictions within the top 25 ranked insurtechs in the region are hong kong. The latter have formed sectors known as the fintech (financial technology) and insurtech (insurance technology) sectors. more flexible and fearless than the long standing behemoths of the sector, the young companies in this new sector aim to replace the technology currently in place with new and innovative digital models.

Comments are closed.