Analytics In Insurance Predictive Analytics In Insurance Analytics Applications Great Learning

Analytics In Insurance Predictive Analytics In Insurance Analyticsо The use cases for behavioral data science and artificial intelligence especially in applications and claims are seemingly endless. according to lexisnexis risk solutions, the top three areas where health insurance companies benefit from the use of predictive analytics are: data driven claims decisions. reduced operating expenses. 6) identifying outlier claims. one of the best use cases for predictive analytics in insurance is how it can help identify claims that unexpectedly become high cost losses — often referred to as outlier claims. with proper analytics tools, p&c insurers can review previous claims for similarities – and send alerts to claims specialists.

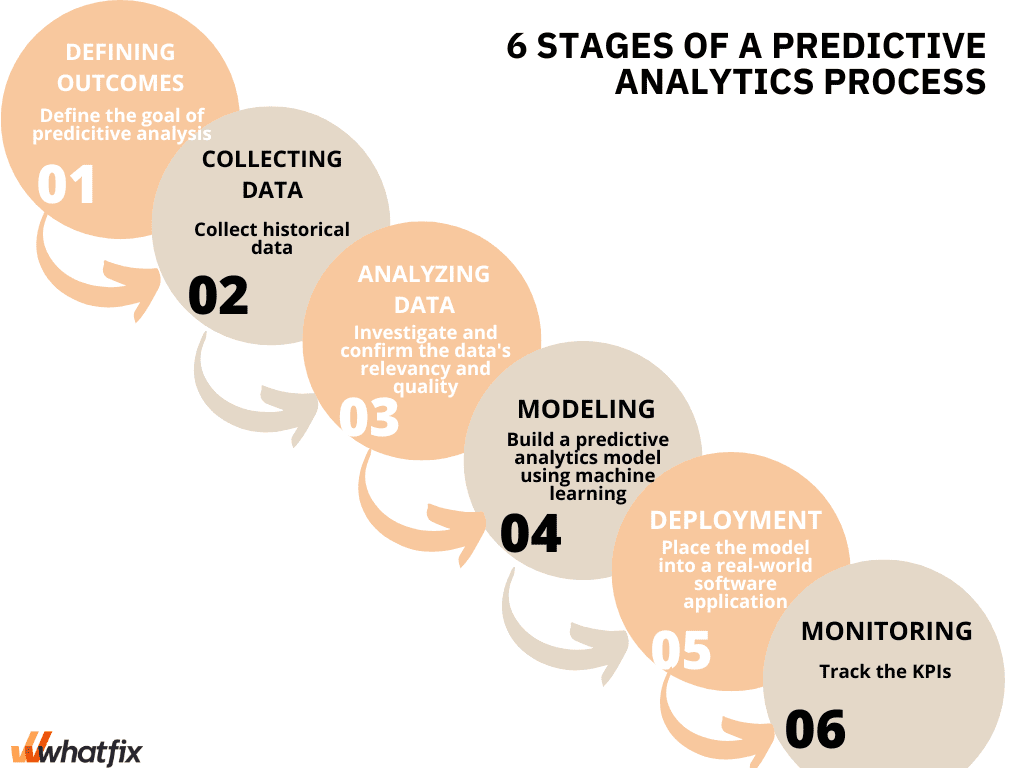

Predictive Analytics In Insurance Benefits Use Cases Whatfix Predictive analytics in insurance involves the collection and analysis of large data sets to reveal repeating patterns in the past and predict the likelihood of damage, fraud, risk of policy cancellation, and other events. the practice of using predictive analytics in insurance is not new. in fact, insurance companies have been relying on it. Predictive analytics in the insurance industry is a business intelligence technology that can determine the most probable outcomes based on patterns in data. although predictive analytics is not a new concept, the emergence of big data, artificial intelligence, and machine learning has made the process simpler and more precise. The impact of predictive analytics on the insurance industry is so profound that towards data science forecasts the rise of “insurtechs,” which are small, entrepreneurial companies with experience in applying data, ai, and mobile applications. these firms can pose a serious threat to established insurers that fail to “reinvent and. The role of predictive analytics in insurance. insurers leveraging predictive analytics for customer centric strategies witness a 20% improvement in customer retention rates, as reported by a survey conducted by deloitte. the ability to anticipate customer needs and tailor offerings enhances overall satisfaction and loyalty.

Insurance Analytics Project Analytics Applications Predictive The impact of predictive analytics on the insurance industry is so profound that towards data science forecasts the rise of “insurtechs,” which are small, entrepreneurial companies with experience in applying data, ai, and mobile applications. these firms can pose a serious threat to established insurers that fail to “reinvent and. The role of predictive analytics in insurance. insurers leveraging predictive analytics for customer centric strategies witness a 20% improvement in customer retention rates, as reported by a survey conducted by deloitte. the ability to anticipate customer needs and tailor offerings enhances overall satisfaction and loyalty. Predictive analytics helps many different businesses and industries — healthcare, retail, manufacturing, entertainment, etc. today, we’ll focus on the use of predictive analytics in the insurance industry – its standard process and the impact on different types of insurance, and will go through the most popular use cases in this industry. Predictive analytics, a branch of data science, entered the insurance scene as a game changer. it involves the use of statistical models and machine learning algorithms to analyze vast datasets and make predictions about future events. in the insurance context, these predictions relate to risks, customer behavior, and claims outcomes.

Insurance Risk Assessment Using Predictive Analytics Predictive analytics helps many different businesses and industries — healthcare, retail, manufacturing, entertainment, etc. today, we’ll focus on the use of predictive analytics in the insurance industry – its standard process and the impact on different types of insurance, and will go through the most popular use cases in this industry. Predictive analytics, a branch of data science, entered the insurance scene as a game changer. it involves the use of statistical models and machine learning algorithms to analyze vast datasets and make predictions about future events. in the insurance context, these predictions relate to risks, customer behavior, and claims outcomes.

Comments are closed.