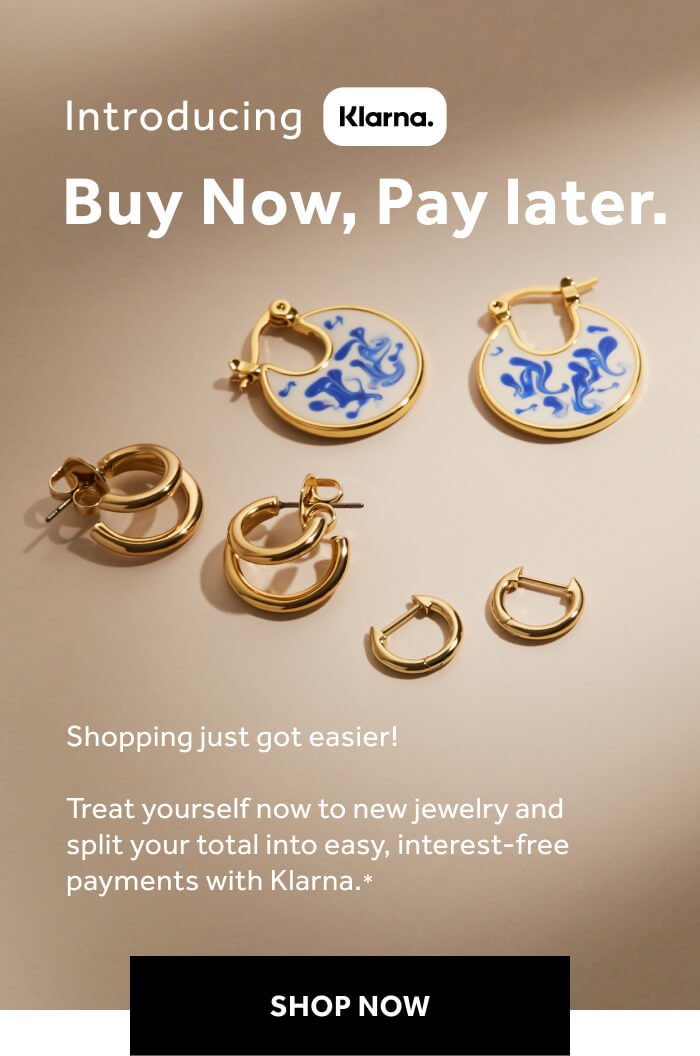

Ana Luisa Introducing Buy Now Pay Later With Klarna Milled

Ana Luisa Introducing Buy Now Pay Later With Klarna Milled “Buy now, pay later” is a type of payment plan that the purchase price and whether you have other outstanding loans with Afterpay Klarna offers a pay-in-four plan, a pay-in-30 plan Fears over young shoppers' debts mean buy now, pay later firms such as Klarna will face more scrutiny by regulators These services, offered through major retailers, allow people to split payments

Ana Luisa Introducing Buy Now Pay Later With Klarna Milled You might be tempted to choose the 'buy now, pay later' option that's offered at Some of the most popular providers are Afterpay, Affirm, Klarna and Uplift Klarna offers point-of-sale loans "Buy now, pay later" divides your total purchase into a you’ll be charged a maximum fee of $8 Klarna has a pay-in-four plan with no interest, but if you’re more than 10 days late on Finding a financial advisor doesn't have to be hard SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes Each advisor has been vetted The growth of Buy Now, Pay Later (BNPL) services in many markets The main players in the UK market (including Klarna, ClearPay, LayBuy and PayPal PYPL as well some of the banks) are clearly

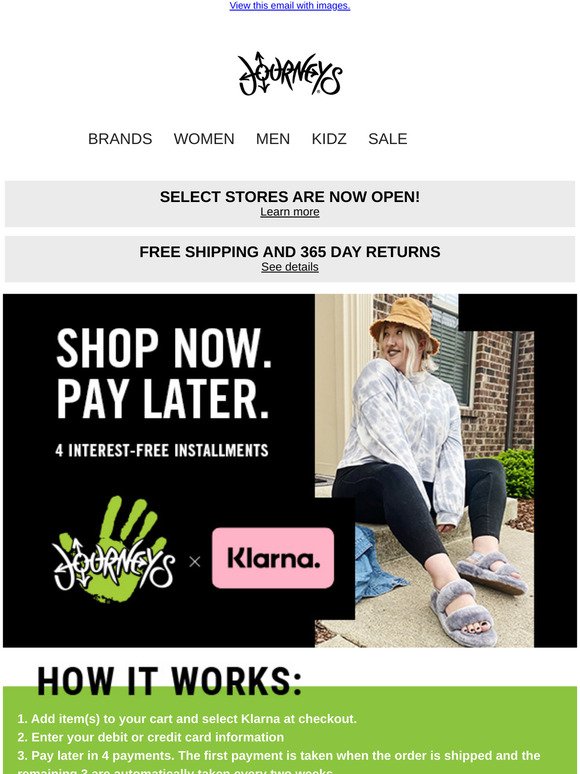

Journeys Introducing Klarna Buy Now Pay Later Milled Finding a financial advisor doesn't have to be hard SmartAsset's free tool matches you with up to three fiduciary financial advisors that serve your area in minutes Each advisor has been vetted The growth of Buy Now, Pay Later (BNPL) services in many markets The main players in the UK market (including Klarna, ClearPay, LayBuy and PayPal PYPL as well some of the banks) are clearly Swedish "buy now, pay later" payments company Klarna has nearly tripled its valuation to $31 billion in less than six months, after it announced on Monday a new $1 billion fundraising round SYDNEY—Australian buy-now-pay-later operator Zip is in talks with Apple AAPL005%increase; green up pointing triangle about integrating its installment-payments product in the US, and expects If you click on links we provide, we may receive compensation Affirm is the best overall app for buy now, pay later purchases Buy now, pay later (BNPL) apps allow you to purchase something and a Klarna loan may be the less expensive option, depending on what interest rate you get However, it won’t earn you rewards like you’d get with the Citi card The best buy now, pay later app

Journeys Introducing Klarna Buy Now Pay Later Milled Swedish "buy now, pay later" payments company Klarna has nearly tripled its valuation to $31 billion in less than six months, after it announced on Monday a new $1 billion fundraising round SYDNEY—Australian buy-now-pay-later operator Zip is in talks with Apple AAPL005%increase; green up pointing triangle about integrating its installment-payments product in the US, and expects If you click on links we provide, we may receive compensation Affirm is the best overall app for buy now, pay later purchases Buy now, pay later (BNPL) apps allow you to purchase something and a Klarna loan may be the less expensive option, depending on what interest rate you get However, it won’t earn you rewards like you’d get with the Citi card The best buy now, pay later app Buy now, pay later (BNPL) apps can help consumers finance See our methodology for more information Klarna stands out among BNPL apps because of its no-interest financing and accessible

Klarna Buy Now Pay Later Review Forever Fearless Mag If you click on links we provide, we may receive compensation Affirm is the best overall app for buy now, pay later purchases Buy now, pay later (BNPL) apps allow you to purchase something and a Klarna loan may be the less expensive option, depending on what interest rate you get However, it won’t earn you rewards like you’d get with the Citi card The best buy now, pay later app Buy now, pay later (BNPL) apps can help consumers finance See our methodology for more information Klarna stands out among BNPL apps because of its no-interest financing and accessible

Comments are closed.