Advantages Disadvantages Of Whole Life Insurance Policies

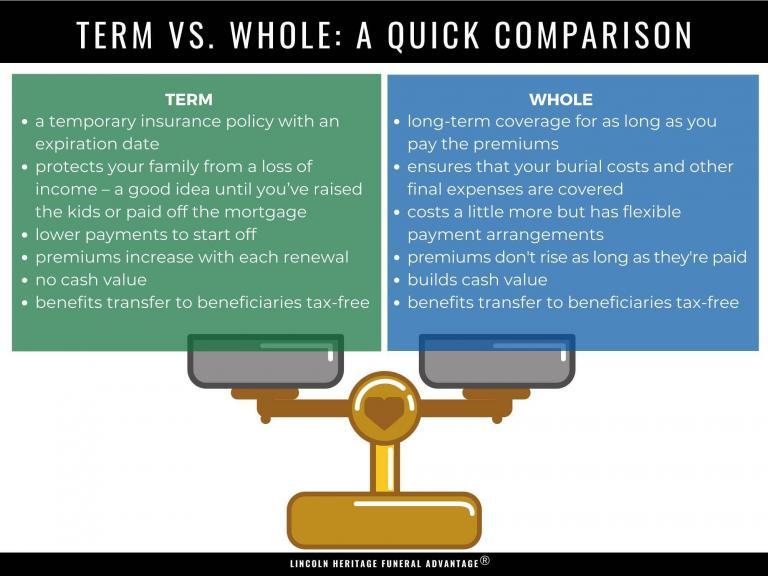

Term Vs Whole Life Insurance 2022 Guide Definition Pros Cons Pros of whole life insurance permanency . as long as you keep up with the premiums, a whole life policy can last your entire life. a term policy, on the other hand, is good for a certain number of. Pros and cons of using whole life insurance as an investment. whole life insurance can offer both advantages and disadvantages. here’s a quick rundown of the main pros and cons. pros: whole life.

Whole Life Insurance Permanent And Guaranteed Protection Whole life insurance does that, and also becomes a cash asset over time. but it might be years before you’ll be able to make the most of its living benefits. advantages of whole life insurance. these are the main perks of taking out a whole life insurance policy: it provides lifelong protection. unlike term life, whole life insurance lasts a. Term life vs. whole life: cost comparison. whole life policies are much more expensive than term life policies. in fact, rates for whole life policies are typically between five and 15 times more. Whole life insurance policies have limited flexibility compared to other life insurance products. death benefit amounts and premiums can’t be changed, so it’s crucial to carefully review the terms and conditions before finalizing a whole life insurance contract. 3. cash value grows slower than traditional investments. Whole life insurance is the most common type of permanent life insurance, which includes any policy that lasts for your entire life. known for its dependability, whole life comes with premiums and a death benefit that stay the same for the entire policy. your cash value account also grows at a steady interest rate, providing a guaranteed source.

Features Benefits Of Permanent Whole Life Insurance Paisabazaar Whole life insurance policies have limited flexibility compared to other life insurance products. death benefit amounts and premiums can’t be changed, so it’s crucial to carefully review the terms and conditions before finalizing a whole life insurance contract. 3. cash value grows slower than traditional investments. Whole life insurance is the most common type of permanent life insurance, which includes any policy that lasts for your entire life. known for its dependability, whole life comes with premiums and a death benefit that stay the same for the entire policy. your cash value account also grows at a steady interest rate, providing a guaranteed source. Disadvantages of a whole life insurance policy. expensive: whole life insurance policy tends to be an expensive way to buy coverage. depending on your priorities, a different type of life. It's free, simple and secure. whole life insurance, by definition, covers you for your entire life, as long as you pay the premiums. it is sometimes referred to as "guaranteed whole life insurance," because companies promise to keep premiums the same the whole time you have the policy. if you die, and the policy hasn't lapsed, your.

Comments are closed.