21 Useful Insurance Terms You Should Know Part 55

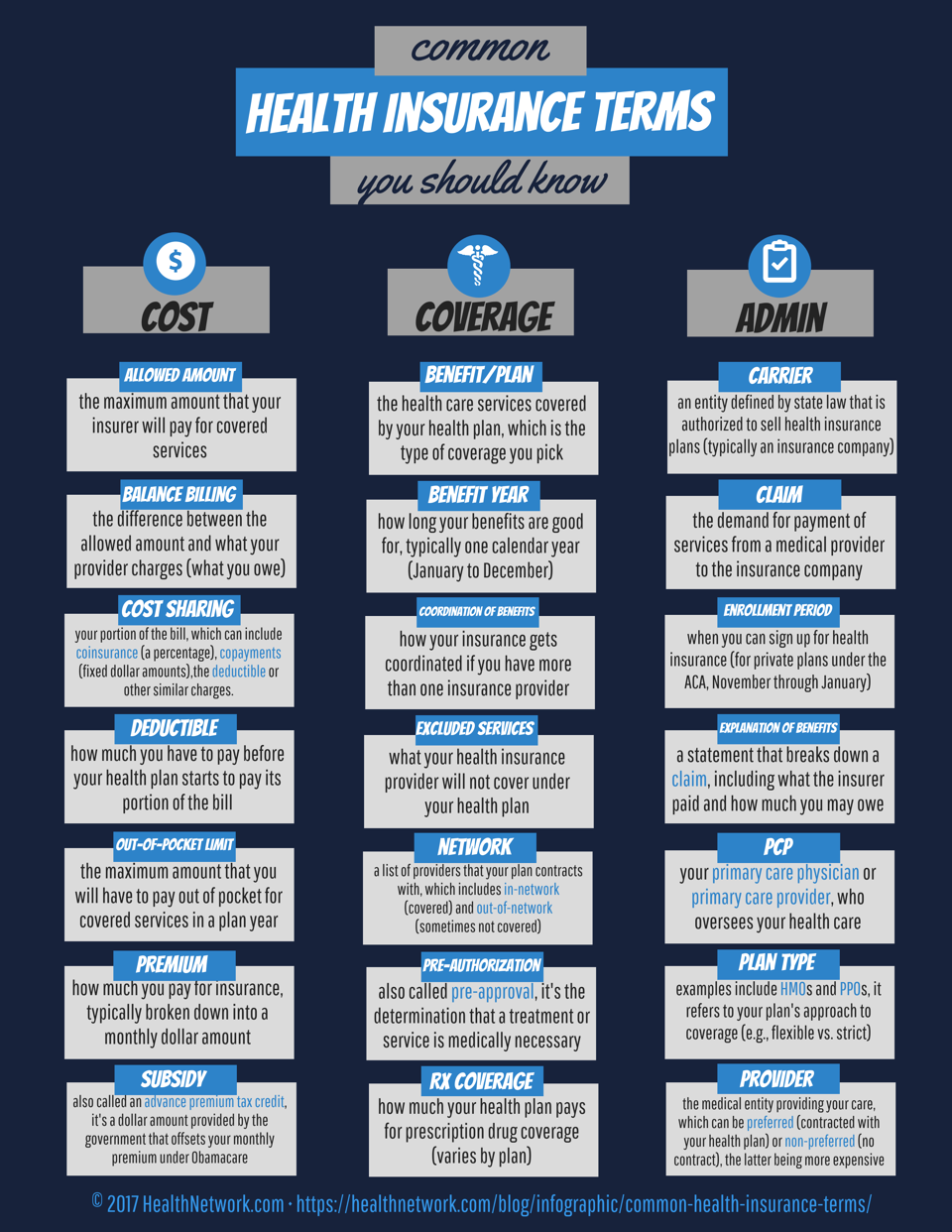

Common Health Insurance Terms Healthnetwork The insurance terms below are divided into five categories: general terms – for buzzwords that apply to all insurance policies. auto insurance terms – for terms that apply exclusively to car. 21 useful insurance terms you should know. posted on may 20, 2024 by admin. insured a person or corporation that contracts for insurance policies to protect him from loss or damage to his property, or in the case where he has a liability policy, defend him from any claim by a third party. named insurred – a person, company, or firm that is.

21 Insurance Glossary Everyone Should Know Youtube Common insurance terms and definitions. 1. actual cash value. there are a few ways your policy can be set up that impact the amount you are paid when filing a claim. actual cash value is one such method, and it is calculated by subtracting the amount of depreciation from the initial cost of the property. Insurance can be complicated, but our comprehensive guide to common insurance terms will give you everything you should know about insurance policies, coverages, and basic terminology. browsing the glossary of definitions below can give you the knowledge to better understand your policy and other important information about all types of insurance. Payments made by the insurance company periodically for a certain time. assignment assignment the term used to describe a transfer in insurance. the term used to describe a transfer in insurance. assignor assignor the party who assigns insurance rights and benefits from policyholders to other people. 12. limit. in insurance, your policy limit is the maximum amount of money that the insurance carrier will pay out for each type of claim. limits are clearly outlined in the terms of your policy. generally speaking, the higher your limits, the more you will pay in monthly premiums for additional coverage. 13. loss.

Common Insurance Terminology Insurance Payments made by the insurance company periodically for a certain time. assignment assignment the term used to describe a transfer in insurance. the term used to describe a transfer in insurance. assignor assignor the party who assigns insurance rights and benefits from policyholders to other people. 12. limit. in insurance, your policy limit is the maximum amount of money that the insurance carrier will pay out for each type of claim. limits are clearly outlined in the terms of your policy. generally speaking, the higher your limits, the more you will pay in monthly premiums for additional coverage. 13. loss. Here are the basic insurance terms you should familiarize with to equip yourself better to navigate the insurance jungle. 1. actual cash value. actual cash value (acv) is a common term in property and casualty insurance. acv refers to the amount payable to a policyholder after deduction of depreciation of the property. Claim: this is the request the policyholder (that’s you) or another involved party makes to the insurance company, asking for compensation for a loss (e.g., auto or home repair costs). an example of “another involved party” would be another driver with whom you collide in an auto accident. when you make a claim, you become the “claimant.

55 Insurance Terms You Should Know About Insurance Busines Here are the basic insurance terms you should familiarize with to equip yourself better to navigate the insurance jungle. 1. actual cash value. actual cash value (acv) is a common term in property and casualty insurance. acv refers to the amount payable to a policyholder after deduction of depreciation of the property. Claim: this is the request the policyholder (that’s you) or another involved party makes to the insurance company, asking for compensation for a loss (e.g., auto or home repair costs). an example of “another involved party” would be another driver with whom you collide in an auto accident. when you make a claim, you become the “claimant.

Insurance Terms You Should Explain To Your Clients Turtlemintpro

Comments are closed.