2024 Bonus Depreciation Rate Irs Dixie Madlen

2024 Bonus Depreciation Rate Irs Dixie Madlen A6: first, bonus depreciation is another name for the additional first year depreciation deduction provided by section 168 (k). prior to enactment of the tcja, the additional first year depreciation deduction applied only to property where the original use began with the taxpayer. the new law expands the definition of qualified property to. To calculate bonus depreciation for a specific asset: subtract any section 179 expense deduction for the year from the original cost of the asset. reduce the basis by the applicable percentage of any credits claimed (such as the energy credit). multiply the bonus rate (60% for 2024) by the remaining cost of the asset.

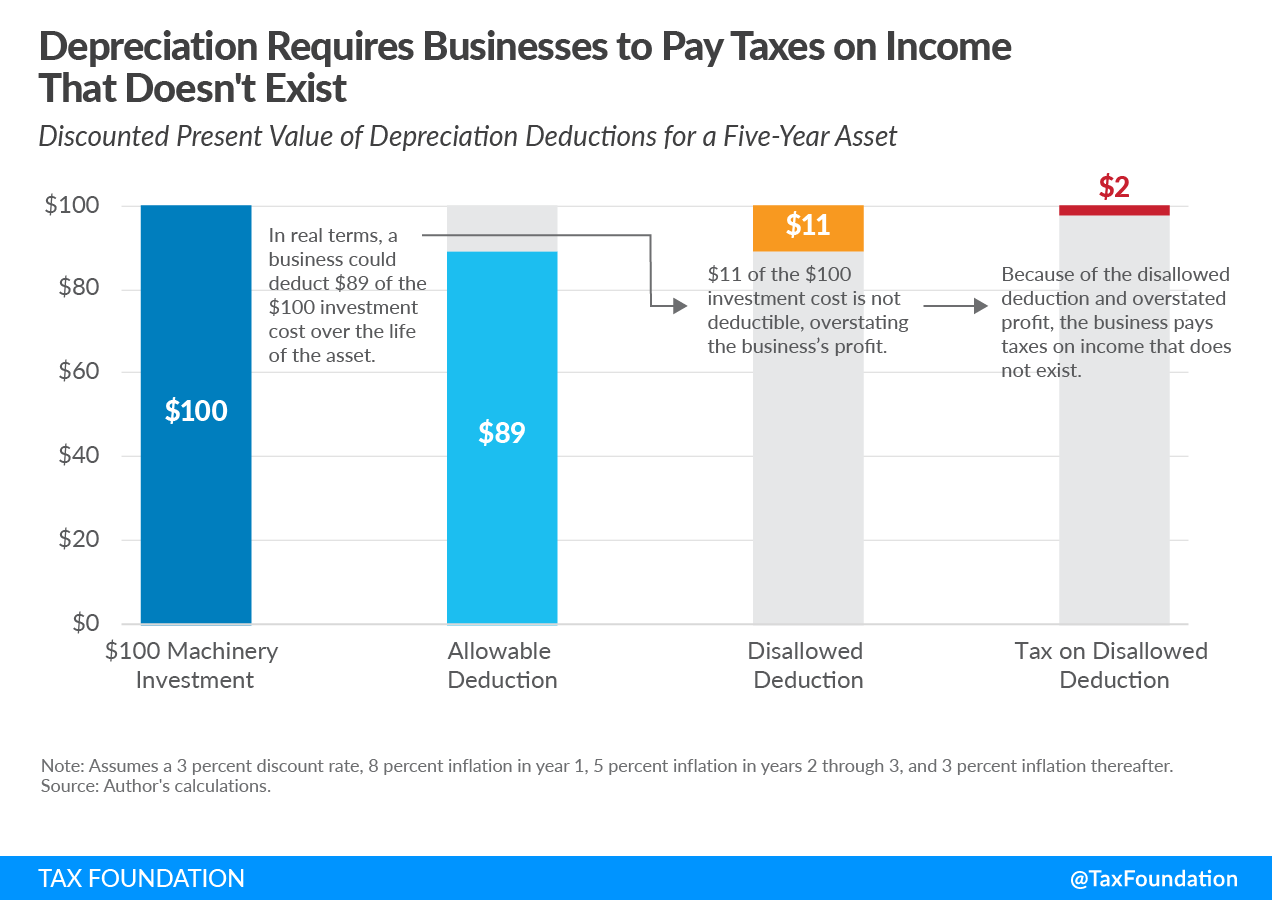

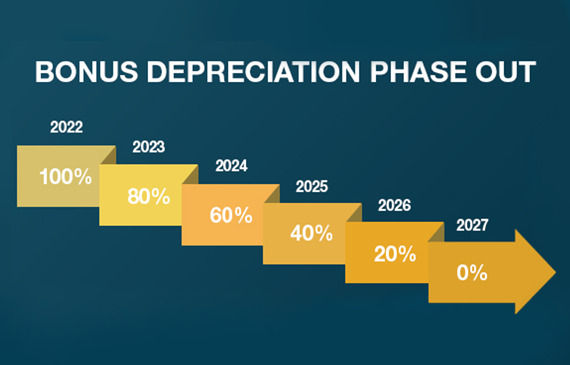

2024 Bonus Depreciation Rate Irs Dixie Madlen Plan for asset purchases to align with bonus depreciation eligibility, particularly focusing on the higher rate periods. for 2024, aim to place assets into service before the rate drops further in 2025. combine with section 179: utilize both bonus depreciation and section 179 expensing to maximize tax savings. while section 179 provides an. The full house passed late wednesday by a 357 to 70 vote h.r. 7024, the tax relief for american families and workers act of 2024, which includes 100% bonus depreciation, as well as research and. In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn’t take action to extend it). for example, say a company purchases a $200,000 piece of equipment and places it in service during the 2023 year. The concept of bonus depreciation has long served as a significant tax incentive for businesses, allowing for the accelerated depreciation of certain business assets in the first year of service. however, as we navigate through 2024, it is imperative to understand the shifts that have occurred within this tax provision.

Bonus Depreciation Decreased For 2024 In 2024, the bonus depreciation rate will drop to 60%, falling by 20% per year thereafter until it is completely phased out in 2027 (assuming congress doesn’t take action to extend it). for example, say a company purchases a $200,000 piece of equipment and places it in service during the 2023 year. The concept of bonus depreciation has long served as a significant tax incentive for businesses, allowing for the accelerated depreciation of certain business assets in the first year of service. however, as we navigate through 2024, it is imperative to understand the shifts that have occurred within this tax provision. Extension of 100% bonus depreciation. the bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026. without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. deductions for r&d. If business use is 50% or less, you can’t claim any bonus depreciation or sec. 179 expensing. irs guidance provides the 2024 depreciation limits for “luxury” business vehicles. for vehicles placed in service in 2024, depreciation limits (including first year bonus depreciation) are $20,400 for year one, $19,800 for year two, $11,900 for.

Bonus Depreciation 2024 Irs Xylia Katerina Extension of 100% bonus depreciation. the bill delays the beginning of the phaseout of 100% bonus depreciation from 2023 to 2026. without this retroactive treatment, bonus depreciation would be 80% in 2023 and 60% in 2024. deductions for r&d. If business use is 50% or less, you can’t claim any bonus depreciation or sec. 179 expensing. irs guidance provides the 2024 depreciation limits for “luxury” business vehicles. for vehicles placed in service in 2024, depreciation limits (including first year bonus depreciation) are $20,400 for year one, $19,800 for year two, $11,900 for.

Comments are closed.