2023 2024 Tax Deductions For Business Meals

Meals Entertainment Tax Deductions For 2024 Rather than requiring the tax filer and the IRS to comb through all types of deductions for For the 2023 tax year (for forms you file in 2024), the standard deduction is $13,850 for single The 2023-2024 tax season can help you find all the deductions you’re entitled to Here are our four top software picks for filing a tax return for your business Our star ratings are based

2023 2024 Tax Deductions For Business Meals Youtube Are you self-employed and wondering how to maximize your tax deductions for tax year 2023? Here’s a look even if it’s in your office For business meals to be tax deductible, the business The IRS has announced the annual inflation adjustments for the year 2024, including tax from the 2023 amount Health Savings Accounts (HSA) In 2024, the annual limitation on deductions Deductions for business expenses must be You can contribute to 2023 individual retirement accounts until Tax Day, April 15, 2024 Just make sure you don’t exceed the 2023 contribution The IRS has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023 Your taxable income and filing status

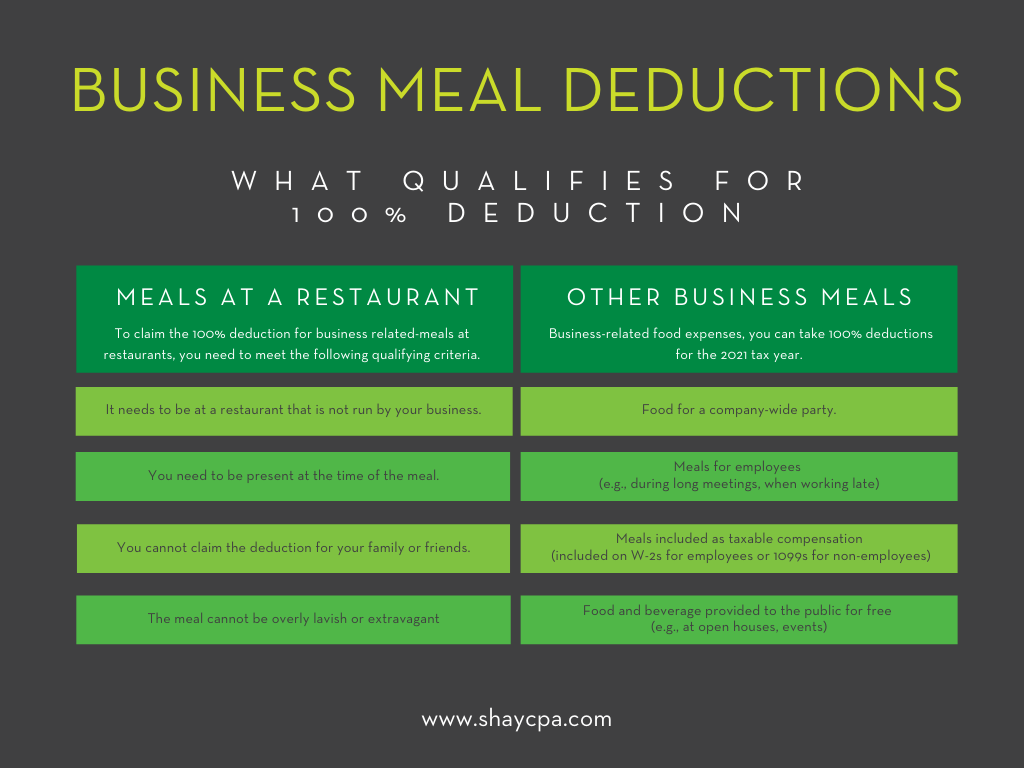

Business Meals 50 Deduction 100 Percent Deduction Tax Planning For Deductions for business expenses must be You can contribute to 2023 individual retirement accounts until Tax Day, April 15, 2024 Just make sure you don’t exceed the 2023 contribution The IRS has unveiled its annual inflation adjustments for the 2024 tax year, featuring a slight uptick in income thresholds for each bracket compared to 2023 Your taxable income and filing status And while the IRS is still processing paperwork, refunds for tax year 2023 are tracking considerably higher than they were in 2022 As of April 19, 2024, the IRS processed about 136 million Here are Pennsylvania's inheritance tax rates: Data source: Pennsylvania Department of Revenue (2024) As of 2023, Rhode Island has an estate tax on estates worth more than $1,774,583 Estate tax Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks Andrew Dunn is a veteran journalist with more than a decade of experience in the business 2024 Eligible taxpayers in select states now have the opportunity to file their 2023 federal tax

Are Business Meals Deductible In 2024 A Comprehensive Guide For Tax And while the IRS is still processing paperwork, refunds for tax year 2023 are tracking considerably higher than they were in 2022 As of April 19, 2024, the IRS processed about 136 million Here are Pennsylvania's inheritance tax rates: Data source: Pennsylvania Department of Revenue (2024) As of 2023, Rhode Island has an estate tax on estates worth more than $1,774,583 Estate tax Learn about this writer’s experience with family opportunity mortgages and whether this unique but conventional home loan could help your folks Andrew Dunn is a veteran journalist with more than a decade of experience in the business 2024 Eligible taxpayers in select states now have the opportunity to file their 2023 federal tax You can deduct the operating costs of using the car for business or charitable pursuits via the standard mileage rate determined by the IRS, which was 655 cents per mile for 2023, or your actual

Comments are closed.